Blogs & Articles

Back Articles

Are you ready for the Corporate Sustainability Due Diligence Directive (CSDDD)?

What is it?

The Corporate Sustainability Due Diligence Directive (CSDDD) is a new initiative from the European Union (EU) requiring companies operating within its borders to submit reports on their impact on human rights, the environment, and climate change, as well as how they are mitigating these impacts. This directive doesn’t just cover direct operations but also extends to the effects of their supply chains, delving into the complex realm of scope 3 emissions.

The new rules are expected to be enforced in the first or second quarter of 2026. They will apply immediately to EU companies (headquartered in the EU and operating in multiple EU countries), with a phase-in period for non-EU companies that have operations within the EU.

Does it apply to you?

The EU Council has categorized four groups of companies to which the CSDDD will apply:

- Group 1: Large companies in the EU.

- Group 2: Medium-sized companies (excluding SMEs) in the EU.

- Group 3: Large companies outside the EU that operate within the EU.

- Group 4: Medium-sized companies outside the EU that operate within the EU.

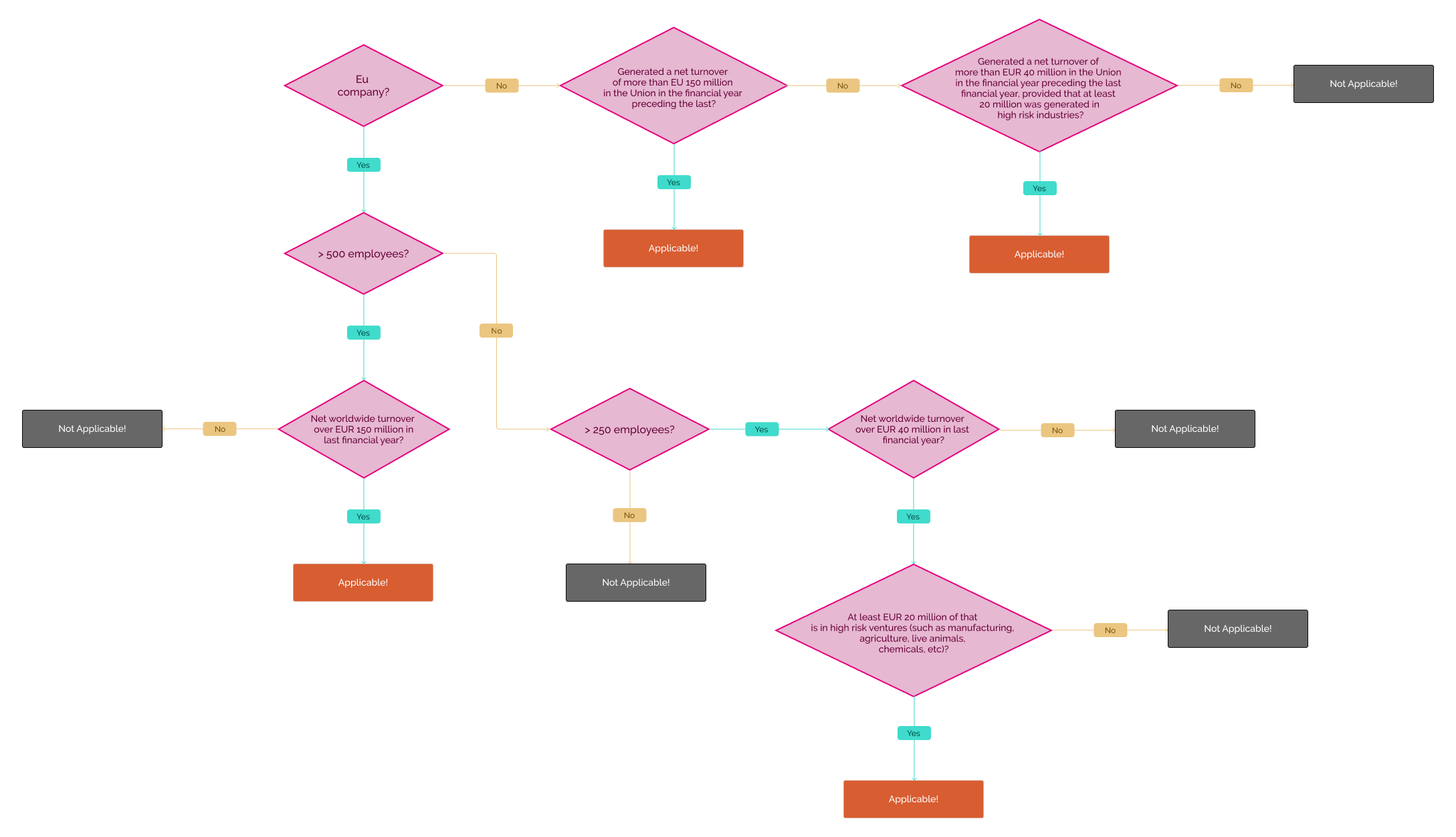

Here’s a handy flowchart to check whether the CSDDD applies to you.

Enforcement and Consequences

Regulatory authorities will be designated in each EU member country. These authorities will collaborate at the EU level under the recently formed European Network of Supervisory Authorities. They will ensure companies adhere to the responsibilities set out in the CSDDD, with the authority to conduct audits and investigations.

Companies failing to meet the new obligations may face sanctions, including public exposure (“name and shame”) and fines of up to 5% of the company’s net turnover.

So, what do you need to do to comply?

Here are some key actions companies will need to take:

- Incorporate considerations for human rights and environmental protection into their company policies.

- Detect both existing and potential negative impacts on human rights and the environment in their operations, as well as in the operations of their subsidiaries and business partners throughout the supply chain (e.g., issues related to child labor, worker exploitation, pollution, and loss of biodiversity).

- Mitigate any negative impacts that have occurred.

- Set up and maintain a system for notifications and a process for grievances.

- Evaluate the effectiveness of their policies and actions regarding due diligence.

- Disclose information about their due diligence practices to the public.

- Align with the Paris Agreement by setting targets to mitigate carbon emissions.

Important extras

- The CSDDD requires a climate change transition plan that builds on the Corporate Sustainability Reporting Directive (CSRD). ESG investors are increasingly making investment decisions that favor the green economy. The data required for reporting to the CSDDD and CSRD will also facilitate access to capital.

- Although the financial industry won’t immediately be subject to external due diligence requirements, they must comply with the climate transition reporting plan.

- Since the CSDDD mandates responsibility over the entire supply chain, reporting on scope 3 emissions data will also be necessary.

Want to solve this before it becomes a problem?

We provide scope 3 emissions data and can help you tackle the most challenging part of complying with the CSDDD. The sooner you start gathering data on your scope 3 emissions, the easier it will be once the CSDDD goes into effect.